5. Standard Retirement or Winning at Entrepreneurship?

Weighing incentives... Capital allocation and operational skillsets

There are playbooks, frameworks, and mental models for literally everything.

We have zero shortage of information on how to get nearly anything you want in this life. Especially money. The question is, do you want to take the “save in your 401(k) til retirement route” or do you want to build a life of thriving?

You have probably heard the “baby boomers hold the wealth” statistics. Some say it’s a myth that it will transfer hands; I know for a fact it will have to transfer hands.

In the above myth article, it says $30 trillion won’t transfer hands; it will stay in the hands of money managers (hurrah), and the second article talks about how the next generation will acquire businesses and create more generational wealth.

We are living in the easiest time in history to build incredible wealth. The information is all available; it is just a matter of what you are going to do with it.

First, though, let’s talk about the elephant in the room. Why retirement may be a cruel trick.

Over the last 12 years, everyone has been an “investing genius.” You could allocate capital to nearly anything and have it grow in nominal terms.

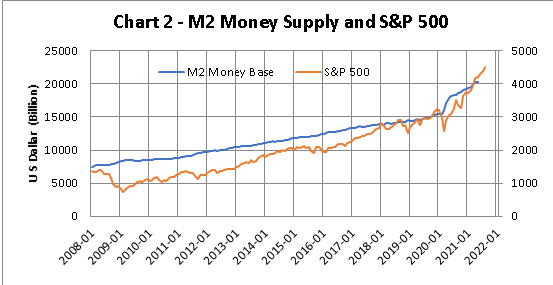

I want to clarify a bit more. Are we really growing our purchasing power? See the chart below.

As the money supply increases, the returns stay in line with the amount of money in circulation. They remain nearly perfectly aligned. If the S&P is following the circulation of money so closely, can one really build wealth to increase purchasing power over time?

This begs the question: are the 401(k) and standard plan of planning for retirement even still valid?

Becoming a millionaire got too easy

As dollars are created and money is printed out of thin air, the value of currently circulating dollars loses value over time. Therefore, over time, it becomes easier and easier to become a millionaire. The thing is, millionaire status isn’t what it once was.

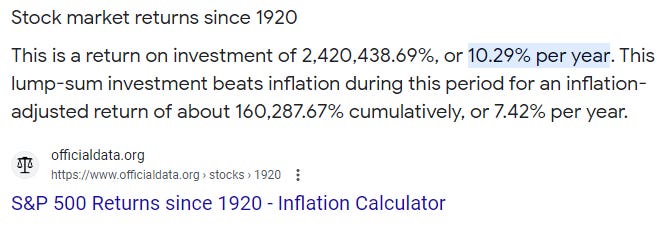

S&P is a poor approach

Inflation is a slow and steady theft of our wealth and time. The S&P has averaged just over 7% returns a year since 1920, helping investors save for their future. But what if I told you there was a better way to survive and ultimately thrive in retirement?

Our world has become a series of boom-and-bust cycles. If you are a baby boomer entering retirement, you know “staying in the market” and not getting scared out of your position has been a wise move.

If you are a younger person who is starting to experience this rising inflation that is happening in the face of a global inflation event and sovereign debt crisis, you don’t have as much breathing room to save for retirement, and you are strategizing what to do today to survive!

Building Businesses / Acquiring Businesses

Next week, I will dive deep into this topic and share some pretty eye-opening data.

The economic incentive to acquire or start a business is stronger than ever, mainly for two reasons.

Starting a business - has some of the lowest overhead costs in all of human history

Acquiring a business - baby boomers are retiring and many businesses won’t sell unless someone strategically acquires them. (Best of all, you can put as little as 5% down)

If real estate has ever caught your attention as a way to build wealth or get passive cash flow, you are going to enjoy this much more. You can replace your W2 job, earn more at the same time, and scale your business into an exit for a far more rewarding life.

Great content, excited to read more! I've been wrestling with the parable of the talents (Matthew 25:14-30), not wanting to be like the servant who buried his talent in the ground (which is what funneling money into the S&P feels like, not to mention the values misalignment), but use my skills and resources to build a business with Kingdom values to grow wealth and a family legacy.